Energy Investor Monthly – August/September 2025

INSIGHTS OF THE MONTH

Alaska LNG: A Major Step Toward Domestic and International Energy Security

As the United States seeks to strengthen its position as a leading global energy supplier—both to help balance trade and to support our allies with reliable energy supplies—there is growing attention being paid to a major natural gas development initiative in Alaska. The Alaska LNG project, which has already attracted more than $100 billion in investment interest, stands to play a transformative role in the future of U.S. energy exports. With its strategic location near Asia and Far East consumers and its access to vast natural gas reserves, the Alaska LNG project could significantly enhance America’s ability to deliver a clean and secure source of energy to the global markets.

The History of LNG in Alaska

The history of exporting natural gas in Alaska dates back more than 50 years, when Phillips Petroleum, which was eventually acquired by ConocoPhillips (COP: NYSE), first began exporting liquified natural gas (LNG) to Japan from its Kenai LNG plant in 1969. With an export capacity of 1.5 million tonnes per annum (mtpa), it was once the largest LNG export facility in the world. The plant operated until 2015, when after years of rising local natural gas demand in the Anchorage, AK region reduced the supply of natural gas available for export to zero. By 2017, the facility was officially closed. Fast forward to today, the Kenai LNG plant is owned by Harvest Midstream, with plans to convert it into an LNG import facility by 2028.

What is the Alaska LNG Project

Conceived in 2013-2014 when crude oil was $115 a barrel, and formally proposed in 2017, when the previous LNG export facility in Alaska was closed, the Alaska LNG project is intended to address three main issues facing Alaska today: managing the surplus of natural gas production from the North Slope, meeting the growing demand for energy in Southcentral Alaska, and reintroducing Alaskan LNG to global markets. The project began as a joint venture between North Slope producers Exxon Mobil (XOM: NYSE), BP Alaska (BP: NYSE), ConocoPhillips (COP: NYSE), and the state-owned Alaska Gasline Development Corp. (AGDC).

When completed, it will be among the world’s largest natural gas development projects, consisting of gas treatment facilities in Prudhoe Bay, an approximately 800-mile, 42-inch-diameter pipeline to Southcentral Alaska – with several offtakes (or connections) for in-state use – and an LNG export facility in Nikiski, AK.

Importantly, the LNG project will be split into three critical phases: treatment, transportation, and liquefaction. Initial treatment of the natural gas will occur near its source in Prudhoe Bay at a facility with three processing trains. Each train, which is comprised of a series of interconnected pieces of equipment, will remove impurities, primarily carbon dioxide (CO2), from the raw natural gas production stream. These impurities can then be “captured” and reinjected into existing hydrocarbon reservoirs, keeping them pressurized for future oil and gas production. In total volume, the three processing trains will give the facility a nameplate processing capacity of 3.5 billion cubic feet per day (Bcf/d) – with the ability to increase to 3.9 Bcf/d if needed.

From there, the now-purified natural gas will be transported from Prudhoe Bay to Nikiski, AK via an 800-mile, 42-inch diameter pipeline, which will have a capacity of 3.3 Bcf/d. Again, along its route, the pipeline will intersect with several new and existing local natural gas systems to ensure there is an adequate future gas supply for all Alaskans.

Since much of the pipeline will follow the same route as the current Trans-Alaska Pipeline System (TAPS), it is expected to minimize its environmental impact and potential issues related to permitting and obtaining rights-of-way. In the project’s terminal point – near the city of Anchorage on the Kenai Peninsula and Cook Inlet – the remaining pipeline gas will feed an LNG export facility located in Nikiski, AK.

For the essential natural gas liquefaction and export phase of this project, the proposed LNG plant will consist of three LNG trains, each a series of highly specialized processing equipment that will cool and compress the natural gas into LNG. Each train will have a capacity of 6.7 mtpa, and once all three trains are operational, the facility will have a total export capacity of 20 mtpa, or equivalent to 2.5 BCF/d (billion cubic feet per day) of natural gas. Because of its size and capacity, the Nikiski facility would be constructed with two berths to accommodate multiple LNG cargo ships.

Why This Project Will Likely Move Forward

Earlier this year, the state-owned Alaska Gasline Development Corp. (AGDC), the primary developer of the Alaska LNG project, transferred control to the Glenfarne Group. This privately held company develops, owns, and operates energy infrastructure assets, including global LNG solutions. Glenfarne Group will complete the final design work required for the project to reach the critical milestone of final investment decision (FID). As of the writing of this article, Glenfarne is expected to reach FID by year’s end, which would allow construction to begin as early as next year.

Clearly, the Alaska LNG project is significant for both Alaska’s citizens and its economy, which is why it has gained increasing support both locally and at the federal level. Recent data show that the State of Alaska produced over 300 Bcf (billion cubic feet) of natural gas, while consuming only 8 Bcf, or just 2.6% of the total available supply. Since Alaska has no LNG export facilities that are currently in operation, the remaining 97% of the state’s production is reinjected into existing oil and gas wells to maintain reservoir pressures and maximize their output. However, without new infrastructure like the Alaska LNG project to process, transport, and export this abundant natural resource, producers have no choice but to continue reinjecting it into the ground – at a loss to everyone. Ironically, as natural gas demand in Alaska has continued to increase, the state now needs to import gas in undersupplied areas to satisfy local demand.

The Next Steps

The obvious solution to achieving both the state’s and the region’s long-term energy goals is the successful completion of the Alaska LNG project. However, justifying the project’s high cost- estimated at $44 billion or more- requires a large LNG export facility to make it economically feasible without substantial government subsidies. Typically, financing a large facility like the one proposed would require long-term supply commitments from several major LNG customers, primarily from Asia.

Now, the future of the Alaska LNG project rests with its stakeholders. Glenfarne Group has taken over the remaining design and engineering work necessary before construction can begin. From a legal and regulatory standpoint, most of the major permits, particularly those from the Federal Energy Regulatory Commission (FERC) and the Army Corps of Engineers, have already been obtained. This leaves only one major hurdle for this project to move forward: sufficient demand. For the Alaskan LNG project to reach FID, Glenfarne, along with its many partners, will need to secure several long-term supply commitments. This includes both international LNG buyers as well as in-state utilities.

However, once a successful FID for the Alaska LNG project has been reached, natural gas could begin flowing from Prudhoe Bay as early as 2030, with LNG exports starting shortly thereafter.

Major Step Toward a Secure Energy Future

The Alaska LNG project represents a strategic opportunity to expand U.S. natural gas exports while also addressing the state’s growing domestic energy needs. By integrating a large-scale LNG export facility with a major pipeline expansion, the project is designed not only to deliver natural gas to global markets but also to ensure a stable and scalable supply for Alaskans. Without this infrastructure, Alaskan residents may increasingly depend on imported energy – despite the state’s abundant natural gas reserves. Alaska LNG offers a practical solution—supporting local energy security and economic development while contributing to the U.S.’s role as a reliable global energy supplier. It’s a win-win for both Alaska and its international partners.

Sources:

- https://alaska-lng.com/

- https://agdc.us/wp-content/uploads/2025/04/2025-04-17_Alaska-LNG-FAQs.pdf

- https://www.eia.gov/naturalgas/data.php

- https://www.gem.wiki/Kenai_LNG_Terminal

- https://www.akbizmag.com/industry/oil-gas/harvest-to-redevelop-kenai-lng-terminal-for-energy-imports/

ENERGY MARKETS BY THE NUMBERS

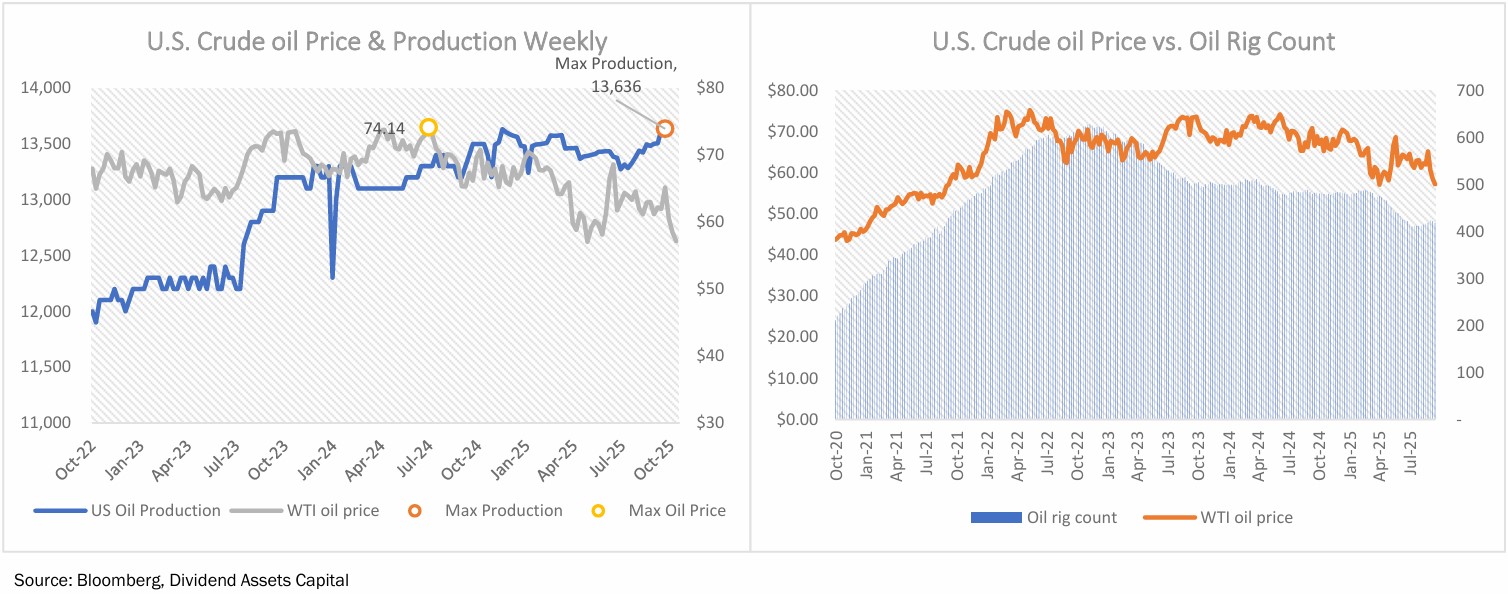

U.S. Total Crude Oil Production and U.S. Crude Rotary Rig Count (as of October 17, 2025):

- West Texas Intermediary (WTI) oil price was $57.15 per barrel (-7.8% m/m)

- U.S. oil production was 13.6mm bbl/d (+0.9% m/m)

- U.S. oil rig count was 418 (Flat m/m)

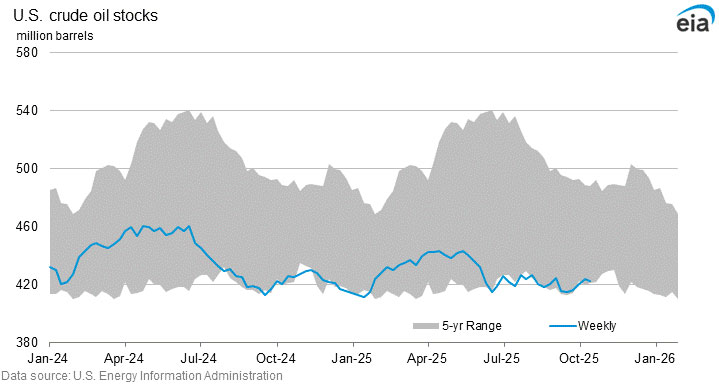

The U.S. Commercial Crude Oil Inventories (excluding those in the Strategic Petroleum Reserve) and Inventory Changes (As October 17, 2025):

- Inventory increased by 8.1 million barrels month over month to 422.8 million barrels (4.1% below the 5-year average).

- Total crude stockpiles, including the Strategic Petroleum Reserve (“SPR”), increased by 10.7 million barrels month over month to 831.4 million barrels.

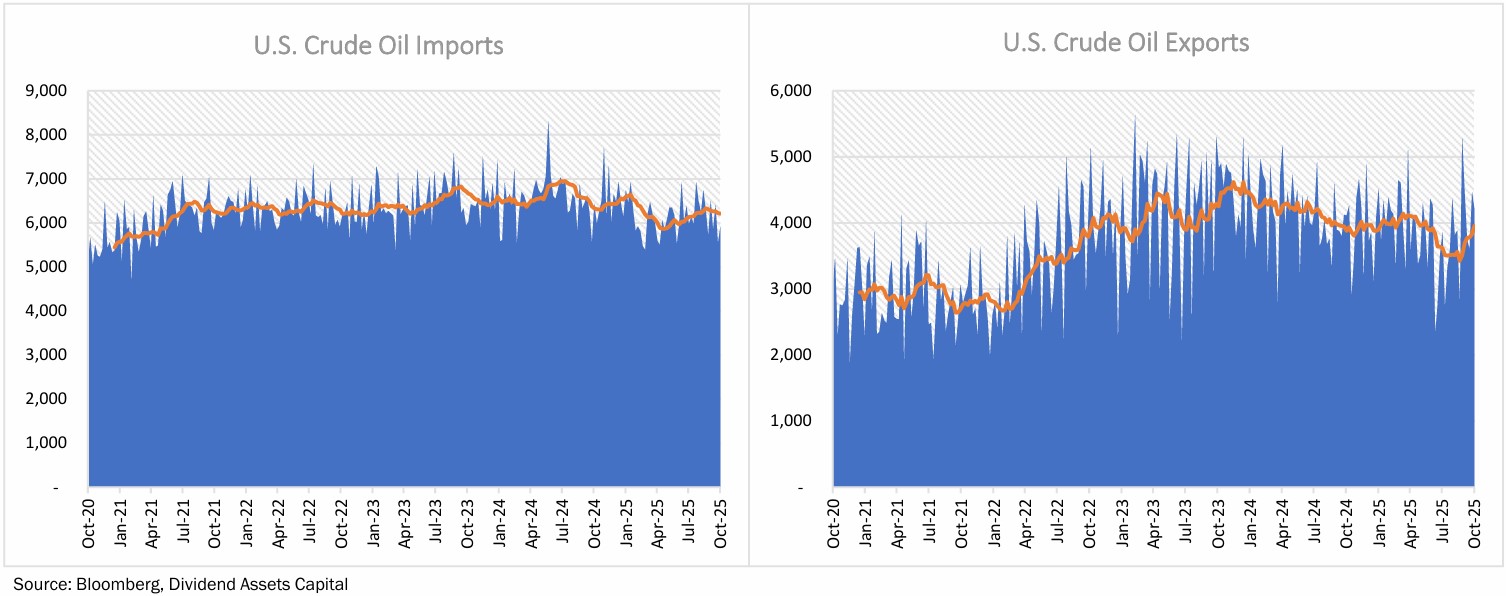

U.S. Imports and Exports (as of October 17, 2025):

- U.S.crudeoil4-weekaverageimportswere5.9mmbbl/d,down6.0%monthovermonth.

- U.S.crudeoil4-weekaverageexportswere4.0mmbbl/d,down2.3%monthovermonth.

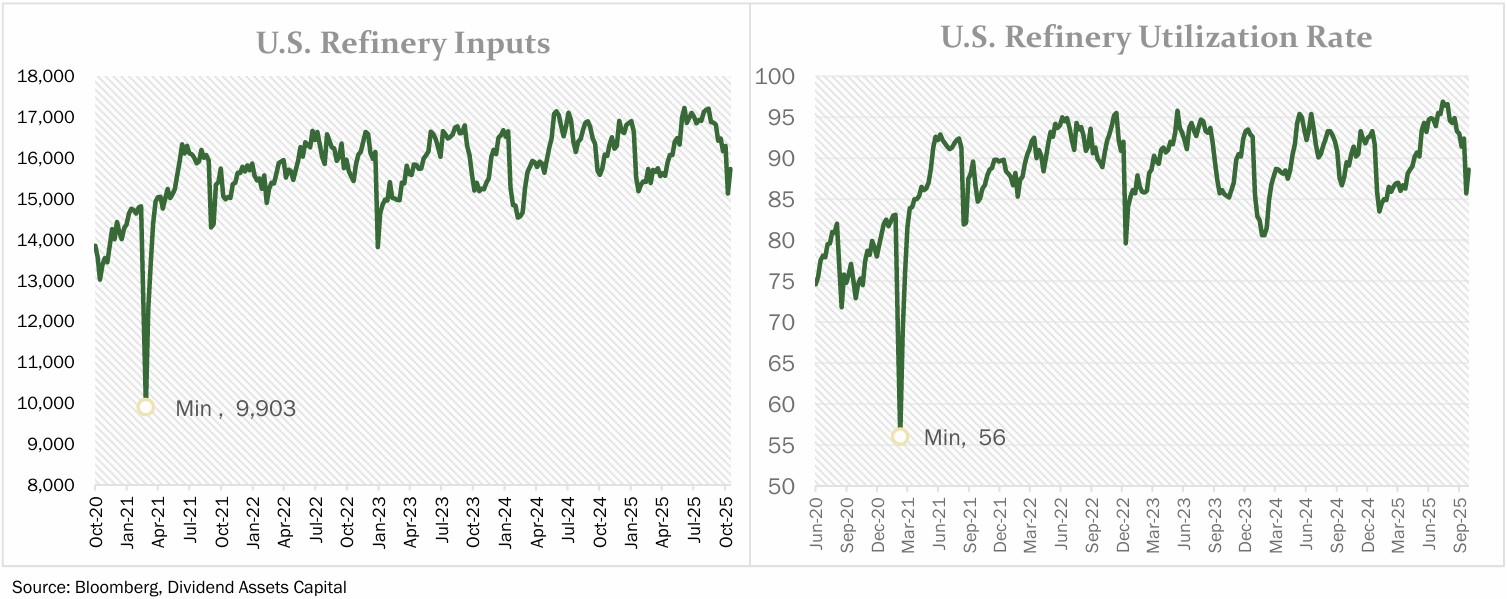

U.S. Refinery Inputs and Utilization Rates (as of October 17, 2025):

- U.S. crude oil refinery inputs averaged 15.7 mm bbl/d. Four-week inputs averaged 15.8million bbl/d,up 0.3% versusthe same time a year ago.

- Refinery Utilization Rate was 88.6%, downfrom 93.0% for the previous month. This is lowerthan the same period last year, which was an89.5% utilization rate.

This information is for illustrative purposes. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing contained in this document may be relied uponasaguarantee,promise,assurance,orrepresentationasto thefuture.

This is not a recommendation to buy or sell a particular security. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable.

Dividend Assets Capital, LLC (“DAC”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about DAC investment advisory services can be found in its Form ADV Part 2, which is available upon request.

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses before investing. The Firm’s Investment Adviser Brochure, Form ADV Part 2, contains this and other information about the Firm, and should be read carefully before investing. You may obtain a current copy of DAC’s Form ADV Part 2 by visiting our website at dacapitalsc.com, emailing info@dacapitalsc.com, or by calling us at (866) 348-4769. Additional information about Dividend Assets Capital, LLC is also available on the United States Securities and Exchange Commission’s website at www.adviserinfo.sec.gov. You may search this site using a unique identifying number known as a CRD. DAC’s CRD is 129973.

DAC-25-040

Dividend Assts Capital, LLC is an independent, employee-owned wealth advisor specializing in high quality companies with a history of consistently increasing dividends. Built on a pioneering legacy, our goal is straightforward; achieve our clients desired outcomes through investments that provide sustainable and rising income with long-term capital appreciation. We partner with successful families, advisors and institutions delivering tailored services that adhere to fiduciary principles to provide…

Clarity: A transparent and understandable approach to portfolio management.

Simplicity: We believe dividends are the best indicator of the future price performance of a stock.

Devotion: We build confidence through a disciplined process and strong devotion to our investment philosophy and clients.