DAC Insights: Growth Of Capital And Growth Of Income

Dividend Assets Capital (DAC) has a rich history spanning over 40 years, rooted in a unique approach to dividend growth investing known as the 3-D process: “Double-digit, Dividend Growth for a Decade or More.” We believe that companies that consistently declare and significantly increase their dividends year after year tend to outperform exceptionally well, for reasons that extend beyond their dividends alone.

Over the years, DAC has perfected the art of combining high-quality companies that pay sustainable and growing dividends into portfolios that offer two significant benefits for investors: long-term capital appreciation AND portfolio income growth. While most discussions about portfolio results focus on total return, we believe that the growth of portfolio income is equally important yet is often underappreciated by most investors.

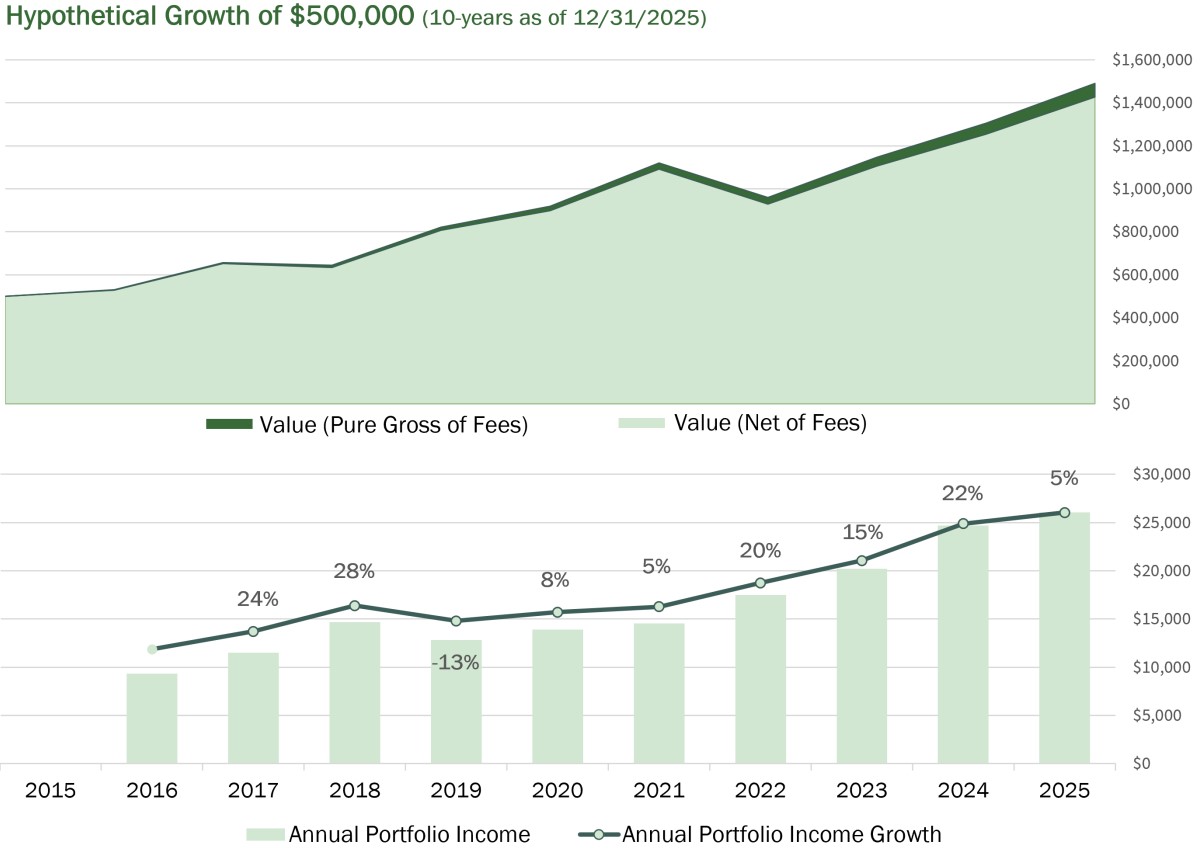

Analyzing the DAC Equity strategy’s performance over the past decade demonstrates how both outcomes can be achieved through a single investment approach. The mountain chart below illustrates how a $500,000 investment in the representative DAC Equity portfolio as of December 31, 2015, grew to $1,490,631 ($1,426,565 net of DAC’s management fee) over a 10-year period. The bar chart below illustrates the increase in annual portfolio income from $9,319 to $26,072 over the same period, representing an average annual growth rate of 12.3%.

The information contained herein has been compiled from sources that Dividend Assets Capital, LLC (“DAC”) believes to be reliable, but no warranty, expressed or implied, is being made that the information is complete or accurate. DAC makes no guarantee that the objectives associated with a particular strategy will be achieved, will equal past performance, or will be profitable. Different types of securities and/or strategies involve varying degrees of risk and have the potential for profit or loss.

Historical performance results generally do not reflect the deduction of transaction and/or custodial charges. The “Pure Gross of Fees” performance results shown in this hypothetical illustration are calculated gross of all fees. The “Net of Fees” value reflects the deduction of DAC’s investment management fee charged to the “Representative Portfolio” for the DAC Equity strategy composite (at 0.45%, or 45 basis points annually). The inclusion of transaction, custodial, and/or advisory fees, as well as other expenses, will reduce actual returns.

Dividend Assets Capital, LLC is a Registered Investment Adviser with the U.S. Securities and Exchange Commission. Registration does not imply any certain level of skill or training. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses before making an investment. The Firm’s Investment Adviser Brochure, Form ADV Part 2, contains this and other information about the Firm and should be read carefully before investing. You may obtain a current copy of DAC’s Form ADV Part 2 by visiting our website at https://dacapitalsc.com/, emailing nfo@DACapitalSC.com, or by calling us at (866) 348-4769. Additional information about Dividend Assets Capital, LLC is also available on the United States Securities and Exchange Commission’s website at www.adviserinfo.sec.gov. You may search this site using a unique identifying number known as a CRD. DAC’s CRD is 129973.

DAC-26-004

Dividend Assts Capital, LLC is an independent, employee-owned wealth advisor specializing in high quality companies with a history of consistently increasing dividends. Built on a pioneering legacy, our goal is straightforward; achieve our clients desired outcomes through investments that provide sustainable and rising income with long-term capital appreciation. We partner with successful families, advisors and institutions delivering tailored services that adhere to fiduciary principles to provide…

Clarity: A transparent and understandable approach to portfolio management.

Simplicity: We believe dividends are the best indicator of the future price performance of a stock.

Devotion: We build confidence through a disciplined process and strong devotion to our investment philosophy and clients.