Informed Dividend Investor – Second Quarter 2025

DIVIDEND INVESTING AND INFLATION

“I remember the $0.05 hamburger and a $0.40-per-hour minimum wage, so I’ve seen a tremendous amount of inflation in my lifetime. Did it ruin the investment climate? I think not.“… Charlie Munger

Dividend investments can help mitigate the erosive effects of inflation on purchasing power. Many dividend-paying companies increase their payouts over time, and these increases often outpace inflation. This is especially true for DAC’s proprietary “3D Double Digits for a Decade or More” universe of dividend growth companies. Quality dividend strategies can also provide superior risk-adjusted returns while maintaining stability and rising income during inflationary cycles.

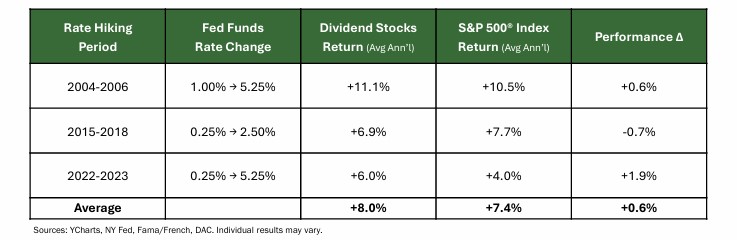

When the Federal Reserve raises interest rates, it’s usually because it’s worried about periods of persistent inflation. Looking back at recent history, it has become increasingly clear that dividend-paying stocks have demonstrated greater resilience than other investments. Take the period from 2004 to 2006, for example, when the Fed sharply raised rates from 1% to 5.25%, companies that regularly paid dividends actually performed better than the broader S&P 500® Index. During the period from 2015 to 2018, when the Fed’s policy tightening was more gradual, investments in dividend-paying companies underperformed the broader market by only a slight margin, but with lower volatility and higher income.

During the most recent rate-hiking cycle from 2022 to 2023, in which the Fed aggressively raised rates from near-zero to over 5%, investments in dividend-paying companies initially were pressured as investors shifted to higher-yielding Treasuries. However, once the Fed’s policy actions pushed short-term Treasury yields above 5%, the highest since 2007, many investors, perhaps fearing a decline in interest rates, returned their attention to dividend-paying investments. In turn, this led to the relative outperformance of investments in dividend-paying companies – especially those with significant dividend growth.

Optimal dividend strategies during inflationary periods focus on companies with consistent dividend growth histories, strong balance sheets, and business models that demonstrate resilience across economic cycles.

Their value is in:

- Real Income Growth: Established dividend-paying companies typically increase their distributions annually, with many demonstrating dividend growth rates that exceed the rate of inflation over multiple-year periods. This organic growth helps investors maintain and grow their purchasing power without requiring excessive portfolio turnover or the added complexity of making decisions about market timing.

- Pricing Power Translation: Companies capable of both sustaining and growing their dividends during inflationary periods typically possess wide competitive moats and superior pricing power. These businesses can typically pass their increased costs on to consumers, maintaining their profit margins and strong cash flow necessary to support the sustainability and growth of their dividends.

- Inflation-Linked Sector Exposure: Many high-quality dividend payers operate in sectors that are naturally hedged against inflation, including utilities with rate adjustment mechanisms, real estate investment trusts with inflation escalating leases, energy companies that benefit from increases in commodity prices, and consumer staples companies with low elasticity of demand for their essential products.

- Superior Total Returns: Historical analysis reveals that dividend-focused equity strategies have consistently outperformed both bonds and non-dividend-paying investments during periods of high inflation. The combination of capital appreciation from earnings growth, along with the benefit of compounding dividend income, generates total returns that typically exceed the rate of inflation by a wide margin.

Dividend growth investments also offer risk mitigation benefits:

- Reduced Interest Rate Sensitivity: Unlike fixed-income securities, which often decline in value as interest rates rise during inflationary periods, dividend growth companies typically maintain or increase in value through their growing income streams, which more readily adjust to changes in economic conditions.

- Cash Flow Certainty: Regular dividend payments provide predictable cash flows that can be reinvested or used to meet living expenses, thereby reducing the need to sell assets at potentially unfavorable times or during periods of high market volatility.

Our conclusion, then:

Dividend growth investments represent a compelling hedge against inflation, addressing both a client’s need for income as well as capital preservation. Historical evidence suggests that while dividend stocks may initially face short-term pressure during periods of aggressive Fed monetary tightening, they tend to outperform over the full market cycle due to their consistent income generation and the quality characteristics that allow them to sustain their dividends regardless of the market environment. By providing a stream of stable and growing income, the financially and operationally resilient companies held in DAC’s “3D Double Digits for a Decade or More” dividend growth strategies can help investors maintain their purchasing power while building long-term wealth, regardless of inflation or the monetary or economic cycle.

DID YOU KNOW?

- According to Bloomberg data, as of 3/31/2025, 8,439 common stocks were listed on U.S Stock Exchanges and domiciled in the U.S.

- Among those stocks, only 1,220 or just over 14% are expected to pay dividends in the next 12 months.

- Among those expected to pay dividends, only 140 companies, or less than 2% of the listed securities, are projected to deliver dividend growth rates over the next three years at or higher than 10% annually.

- Those 140 companies have an average market capitalization of $1.20T and an estimated dividend yield for next the 12mo of 0.93%, 43 bps lower than the S&P500 Index indicated yield of 1.36%.

INVESTMENT PHILOSOPHY… WE BELIEVE DIVIDENDS ARE ONE OF THE BEST INDICATORS OF THE FUTURE PRICE PERFORMANCE OF A STOCK:

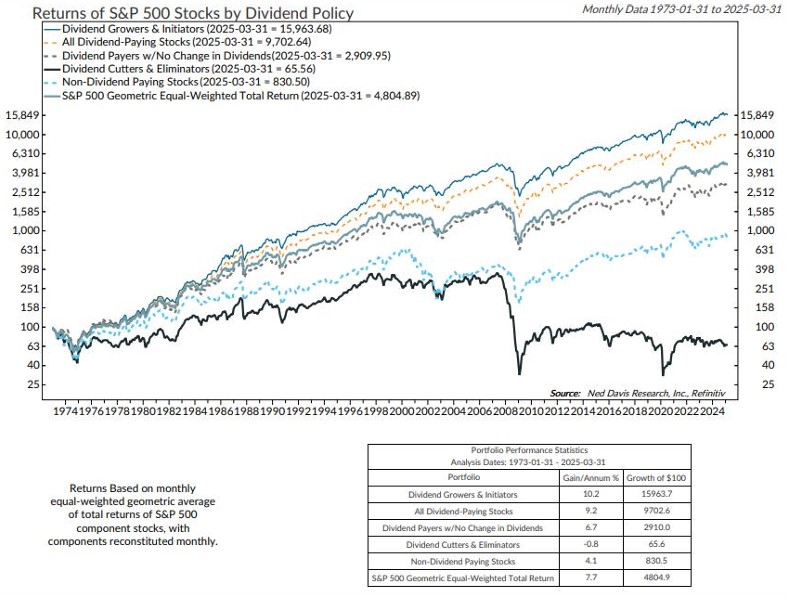

- According to the most recent update from Ned Davis Research (3/31/2025), “Dividend Growers and Initiators” have outperformed all other dividend policies as well as the S&P 500® Equal-Weighted Index, continuing to demonstrate the power of compounding dividend growth.

S&P 500® SECTOR TRACKER (Q1 2025)

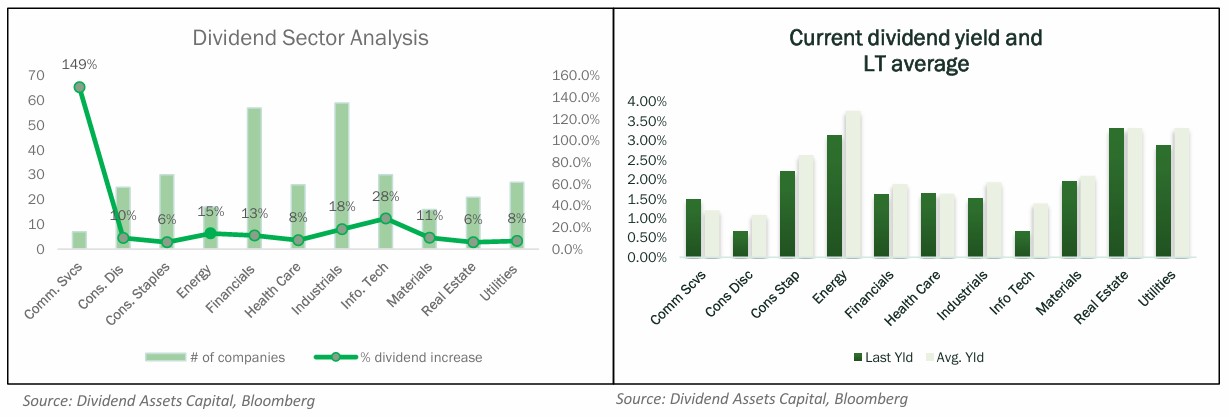

- 315 companies increased their trailing 12-month dividends Y/Y.

- Industrials had the largest number of companies raise their dividends

- Communication Services had the most notable dividend increases, with significant increases also in the Information Technology and Consumer Discretionary sectors.

- From a dividend perspective, the Energy, Real Estate, and Utilities sectors offer the highest absolute dividend yields of about 3.3%, 3.1%, and 2.9%, respectively. All sectors are currently trading at yields below their 10-year average.

- Like earnings, the rate of dividend increase and relative yield changes matter; thus, Energy and Consumer Staples stocks seem attractive.

The Portfolio Performance Statistic Chart is an illustration of Ned Davis Research only and is not data from a portfolio managed by Dividend Assets Capital, LLC.

This information is for illustrative purposes. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. S&P 500® Index includes a representative sample of 500 leading companies in leading industries of the U.S. economy, focusing on the large-cap segment of the market, with over 80% coverage of U.S. equities. Information presented is not an offer to buy or sell, or a solicitation of any offer to buy or sell any securities which may be mentioned herein.

Dividend Assets Capital, LLC (“DAC”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses before investing. The Firm’s Investment Adviser Brochure, Form ADV Part 2, contains this and other information about the Firm, and should be read carefully before investing. You may obtain a current copy of DAC’s Form ADV Part 2 by visiting our website at dacapitalsc.com, emailing info@dacapitalsc.com, or by calling us at (866) 348-4769. Additional information about Dividend Assets Capital, LLC is also available on the United States Securities and Exchange Commission’s website at www.adviserinfo.sec.gov. You may search this site using a unique identifying number known as a CRD. DAC’s CRD is 129973. DAC-25-021

Dividend Assts Capital, LLC is an independent, employee-owned wealth advisor specializing in high quality companies with a history of consistently increasing dividends. Built on a pioneering legacy, our goal is straightforward; achieve our clients desired outcomes through investments that provide sustainable and rising income with long-term capital appreciation. We partner with successful families, advisors and institutions delivering tailored services that adhere to fiduciary principles to provide…

Clarity: A transparent and understandable approach to portfolio management.

Simplicity: We believe dividends are the best indicator of the future price performance of a stock.

Devotion: We build confidence through a disciplined process and strong devotion to our investment philosophy and clients.